The Metropolitan Risk Difference

The Best Construction Insurance Rates. Period.

At Metropolitan Risk we understand the goal of most construction companies is to build it on time and on budget. We also understand the impact significant claims can have on your current and future profits. In the construction industry if your construction insurance and risk-related costs rise by more than 20% it can potentially wipe out a whole years profit. Further, as your insurance costs escalate it could put you underwater on your existing contracts as well as impede your ability to win future work as your competitive position erodes. That’s why it’s so important to partner with someone who can design a risk management program. We help repair companies whose cost structures have eroded so as you go into your next renewal cycle you have proper systems in place so past won’t become prologue.

Your Own O.O.D.A Risk Management System

High insurance costs are ultimately a symptom of your past losses. That’s why we built our proprietary O.O.D.A Risk Management System which allows you to easily manage your risk management program. We give you access to all kinds of claim criteria like causation, location, and even body part. We also tell you how your claims directly affect your costs. With this system, you won’t need to wait until renewal to know where your costs are heading. You will have real time access to reports such as a loss pic, trend analysis and all risk related activity.

Cloud Based, 24/7 Human Resources Team

We have partnered with ThinkHR to provide you with a powerful tool to make quick, accurate and intelligent Human Resources decisions. Businesses across the country are calling it the best HR resource they’ve ever used.

ThinkHR doesn’t make you talk to a machine. Instead, you get access to real live HR professionals. If you don’t have a Human Resources department, now you do! If you have one, make their lives easier, with ThinkHR.

Annual Checkup & Coaching Calls

We think that lasting success stems from accountability – from trust. With our annual check-up, and regular coaching calls, our staff ensures that we’re on top of your account. This check up often includes:

- Loss History Evaluation

- Mod Analysis

- Audit Verification (Audits frequently have errors, the ones we find could mean a check in the mail for you)

- Insurance Marketing Strategy

- Important Claims Updates

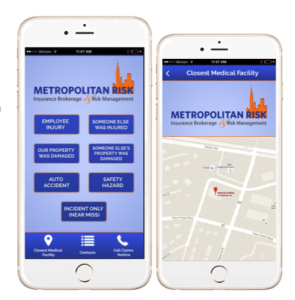

A Mobile App to Manage Your Risk

What happens immediately after an incident occurs is critical to the outcome of a claim. Our new mobile app will allow your supervisors and employees in the field to efficiently notify all stakeholders(and us) when something has happened. From an employee injury to documenting a safety hazard. This ensures a few things:

1. They document the incident. Management finds out about it in a timely manner.

2. They get the necessary treatment, remediation, investigation, etc.